Startup Cities Goodreads: February 2022

Business Parks In Space, geographic arbitrage as a service, Próspera's $150 million crypto raise, Disney towns, ICON hits 2 bill, Solarpunk charrette, Boy Scout Camps, coups in DAO-land... and more!

You’re reading Startup Cities, a newsletter about startups that build neighborhoods and cities.

This week: February’s goodreads roundup.

I’m still figuring out the right sequence for these roundups — which is why February’s roundup is mid-way through March. Whoops. Bear with me and enjoy the reads!

An Archive Finally Built — 10 Years Later

Fans of Startup Cities will like the work of Spencer MacCallum, an entrepreneur-anthropologist who tragically died in 2020. Back in the day I digitized his book The Art of Community. I recommend it.

His examples from the 50’s show their age: this was an era when the trailer park and shopping mall were major innovations. But this tiny book fundamentally changed how I thought about neighborhoods and cities. Spencer was really the mimetic pioneer of entrepreneurship in community, coining the term “entrecomm” (entrepreneurial community) to describe such projects. The term never caught on, but I think Spencer ideas have a bright future.

About ten years ago, I met Spencer in Chihuahua, Mexico. The trip was harrowing. I crossed the border in the middle of the night from El Paso to Juárez. The city was deserted: stray dogs, gated storefronts, and dim streetlights. My cab driver made me lay down on the floor of the back seat, so no one could see my extremely robbable face shimmering in the Juárez moonlight.

We had a great time. I negotiated with Spencer to donate his papers to Universidad Francisco Marroquín, the old home of Startup Cities Institute.

Spencer’s papers are a treasure trove. Not just for his own work, but because they include the work of his grandfather, Spencer Heath, a Victorian-era polymath-inventor and close friend and funder of Henry George.

They also contain the work of monetary theorist and consumer sovereignty pioneer E.C. Riegel. You could argue that Riegel was a crypto-pioneer, since he advocated competing private currencies decades before Twitter was ablaze with such ideas. MacCallum pulled Riegel’s life’s work out of a dumpster when Riegel’s widow threw them away.

Last week, Spencer’s archives arrived to Guatemala City. They will be digitized and put online. This is thanks to the incredible support of Joyce Brand and Massimo Mazzone (founder of Ciudad Morazán). Check out the press release (Spanish). Many thanks to Joyce and Massimo — I’m thrilled that this work finally found a good home!

Those interested in Spencer’s life can read my eulogy for him or Mike Hamel’s excellent biography.

Mixed Use Business Parks... in Space!

In 2019, NASA published its Plan for Commercial Low Earth Orbit Development.

Engadget covers the ventures that heard NASA’s call and now hope to commercialize low earth orbit with space stations. While not exactly cities, it’s interesting to see how these firms conceive of Business Parks In Space.

First up: Axiom Space. Axiom will soon launch a private mission to the ISS in partnership with SpaceX. It’s happening in two weeks! Here’s their promo video, which feels like a nice rejoinder to that awful, defeatist, cheems mindset Superbowl Ad from Salesforce:

And here’s competitor Nanoracks’s new “Starlab” project:

Jeff Bezos’s Blue Origin and Northrop Grumman are also in the Business Parks in Space Race:

The most intriguing document for Startup Cities fans comes from Blue Origin. The project, named “Orbital Reef,” reads like a zero-gravity resort-meets-business-park:

Now anyone can lease access to the space environment – weightlessness and hard vacuum – and experience breathtaking views of our home planet, with 32 vibrant sunrises and sunsets each day.

Whether your business is scientific research, exploration system development, invention and manufacture of new and unique products, media and advertising, or exotic hospitality, you’ll find a berth here.

On the Orbital Reef business park, shared infrastructure supports the proprietary needs of diverse tenants and visitors.

Mixed use, indeed!

Geographic Arbitrage as a Service

Alex Recouso, a Pioneer fellow, shared an interesting internal memo with me that describes his “Freedom as a Service” startup: Baseflow.

Labor, especially skilled labor, is increasingly mobile. Skilled workers from regions like Central America are moving to more attractive jurisdictions like Spain and Portugal. Anyone who’s done the Digital Nomad thing or moved between countries knows the headaches of getting established in a new home. Baseflow hopes to make this easier.

One of the core ideas of this newsletter is that we should think about cities as stacks of technology. Recouso puts this concept into practice by focusing on legal and regulatory processes. In fact, he quite literally combines technologies from providers like Stripe (and some behind-the-scenes mechanical turking) to offer a unified API for relocation. Processes like these tend to be full of transaction costs and terrible customer experiences. There’s surely some opportunities here.

Buena suerte, Alex!

Próspera is Raising $150 Million via Crypto Securities

Prospera opened a $150 million investment opportunity via tokenization platform Securitize.

Here’s Próspera President (and Mississippi State Rep) Joel Bomgar:

By partnering with Securitize to issue our Security Token Offering (STO), we give our investors a frictionless and legally up-to-date way to have direct ownership in Próspera’s first Charter City development.

I try to maintain neutrality on this newsletter and I’m not in the business of investment advice. But a visit to Próspera’s Securitize page offers an interesting glimpse into the financial side of a certain type of city built by startups.

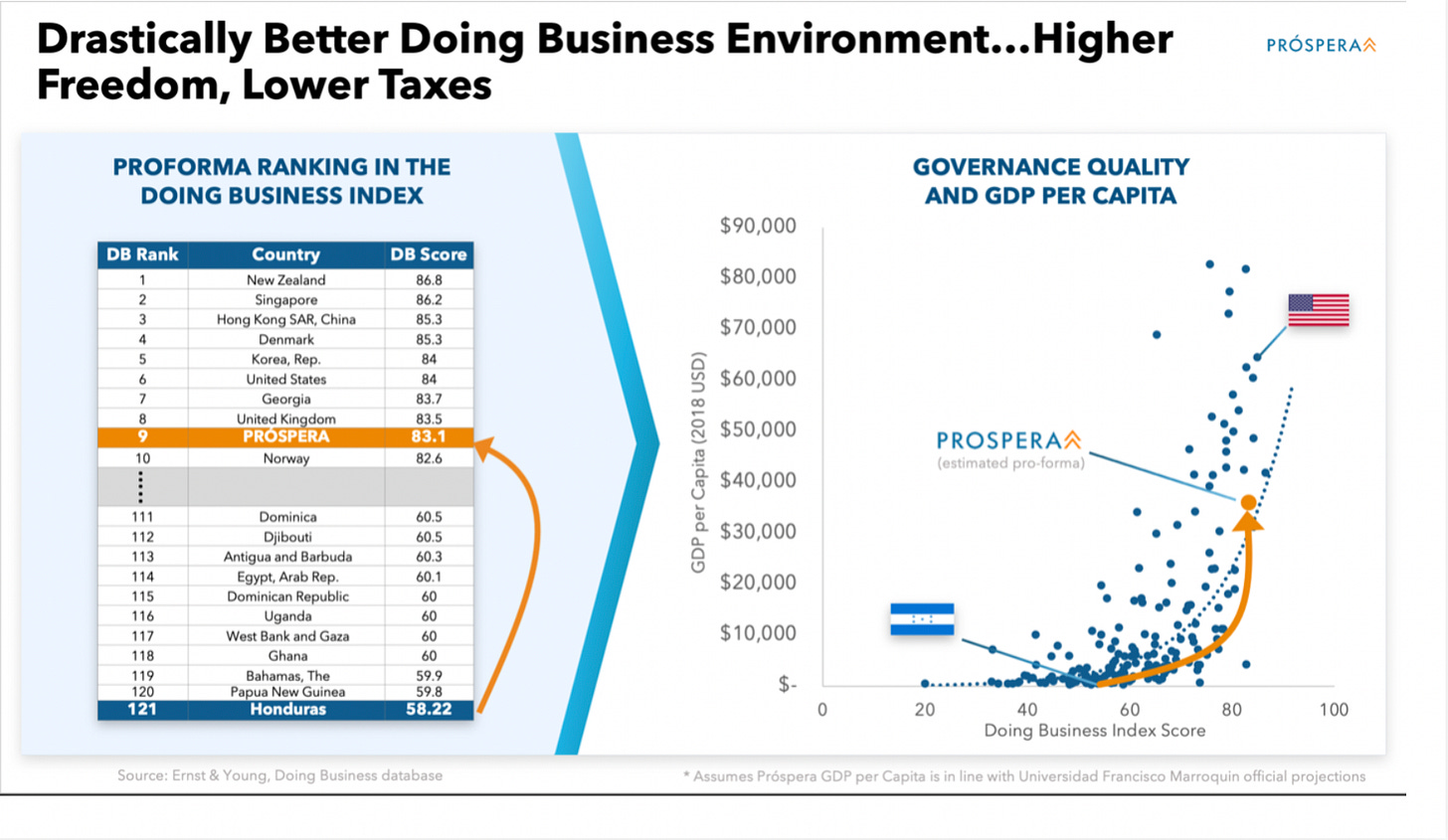

Along with glossy photos and mockups from prestigious architects, Próspera sells itself as a bet on economic freedom. Rather than a typical revenue projection, Próspera cites an E&Y study to project how its legal and regulatory system will raise its per capita GDP.

Próspera highlights a few metrics, which I bet you’ve never seen in a startup pitchdeck before:

Currency

Doing Business Rank

City Footprint

10 Year Population Projection

This prospectus shows how entrepreneurial ownership and management of communities aligns incentives. For the sake of argument, let’s assume E&Y’s projection is right and Próspera is successful. That “up and to the right” curve is a lot of people reaching a better life and leaving poverty. Investors make money, Próspera’s founders get rich, and residents reach a better life.

Próspera innovates on the slice of the city tech stack that I call “social technologies” (a concept I’ve stolen from W. Brian Arthur, Eric Beinhocker, and Richard Nelson). Its focus is primarily the technologies of organizing people: legal procedures, administrative rules, regulatory policies. If the charter cities insight a.k.a “institutions are the most important thing” is correct, then Próspera seems positioned to monetize it. Only time will tell!

A Micromobility Deep Dive

Azeem Azhar has a deep dive into the growing world of micromobility: scooters, e-bikes, electric skateboards, and more.

Micromobility layers into a city better than cars. I first had my mind opened to the possibilities of micromobility while living in Taipei, Taiwan.

Taipei is a brilliant city. But it’s huge and dense. My wife and I were able to move around Taipei (car free) using the many layers of mobility that the city offers: excellent trains for long distance, a U-Bike bike share for medium distances, a scooter for short distances, and a baseline of extreme walkability. We also rented grey-market gasoline scooters (definitely Taipei’s primary mode of personal transit).

I think it’s too soon to know whether micromobility will dethrone the almighty car — especially in the United States. Micromobility seems to layer better in walkable cities. And, sadly, most American cities aren’t walkable.

There’s also the six-days-a-week problem in sprawling American metros: there’s that one day a week where I really need a car. Maybe ride sharing can solve this. Or maybe not. Either way, there’s little doubt that city-dwellers could benefit from an expanded basket of transit options.

The key graph:

NYCers Can’t Trade NYCCoin

Business Insider reports that residents of NYC can’t actually trade NYCCoin, NYC’s answer to MiamiCoin. Reportedly, the coins may only be mined. Why? Because the exchanges that offer the coin don’t have an NY-mandated BitLicense. Hmmmm...

People Want Jobs, Says Not-So-Shocking New Report on Honduran ZEDES

In a finding that should surprise precisely no one, Gallup reports that 67% of Hondurans interviewed agreed with the idea that the new government of Xiomara Castro should use “all legal tools available, including the ZEDEs, to create employment opportunities.”

One annoyance of being in this space for so long is that you end up hearing the same criticisms over and over. There are plenty of reasons why Honduran ZEDEs, individually and as a policy, may fail.

But, for some reason, the majority of criticisms focus on indulgent philosophical issues rather than practical objections. We hear lots of phrases like “neoliberal extrastatecraft” and “fragmented sovereignty.” These objections may have some basis in reality. But, to me, they always feel disconnected from the practical truth that people want jobs and the benefits of economic growth.

Most normal people in Central America (as everywhere else) have real problems to face: safety, employment, education. Practical problems trump all. This Gallup poll only shows that, in practice, most people are worried about the practical things more than the politics.

Here’s the two key graphs with translations.

Priority of the Administration — Remove or Reform the ZEDE Laws vs. Generate Employment

“I would accept work in a ZEDE if conditions were favorable” — Yes vs. No

How to Steal a Major League Baseball Stadium

Scott Beyer (who was interviewed in February) asks: why are so many land titles still managed with paper? He recounts the harrowing story of a mentally ill man who successfully “stole” the San Diego baseball stadium six years ago by forging a deed transfer. These archaic land deed processes reveal just how much room there is for technological innovation in the systems that power our cities.

MiamiCoin: Windfall for Landlords?

CoinTelegraph reports that the City of Miami received their first disbursement of MiamiCoin in February: $5.25 million worth. Mayor Suarez has committed to using the windfall “to fund a rental assistance program for city residents who have experienced severe rent hikes."

Sounds like this tranche of MiamiCoin might end up in the pocket of Miami’s landlords. I’ll be interested to see what Suarez does with future windfalls.

Where Do People Go When They Move to Cities?

The researchers at NYU’s Marron Institute of Urban Management — in my opinion, the best urbanism think tank around — have published a fascinating analysis of how cities have grown.

A lot of people focus on how cities grow up — the growing density of an urban core. This certainly happens. But cities also grow out. As it turns out, they’re growing out much more than they’re growing up.

The key point:

ICON (Nearly) Hits $2 billion Valuation

Austin-based ICON has emerged as the, ahem, icon of 3D printed construction. Their recent $185 million Series B extension puts them at a near $2 billion valuation, according to industry media.

ICON seems to polarize people in the Startup Cities space. Some are enthusiastic. Others claim it’s all hype. I’m much closer to the first camp. Even if the technology is not yet cheaper than some traditional methods, as some critics claim, we shouldn’t assume that will be true forever.

To me, ICON is potentially a “software eats the world” approach to construction. The main product isn’t software: it’s the robots that print layers of magic concrete. But this approach is more software than traditional approaches.

If the robots can deliver, we should expect significant price decreases and probably also faster iterations (and therefore likely more innovation). We don’t know what the future holds, but the naysayers should consider the tantalizing possibility: what if ICON is right?

NYC with 25% Fewer Cars

FastCompany shares a report by alternative transit activists that imagines NYC streets with 25% fewer space for cars.

It’s hard to deny the fundamental point: cars are dangerous and take up a lot of space. But some of the report seems a bit disingenuous. For example, check out this gif:

The fewer-cars-city apparently also has better weather, nicer lighting, superior trash service, and future-cobblestones with micro-gardens! Who knew we could achieve so much just by trashing cars?

I’m conflicted on the broader theme of mobility. Clearly, it’s important: Alain Bertaud devotes a long chapter of Order Without Design to mobility!

But I’m tempted to argue that adjacent innovations, far from the battlegrounds of urban policy, may be the deciding factors in future mobility. Is banning cars better than innovating micromobility, electric cars getting better and cheaper, or frontier innovations like flying taxis and self-driving human mover pods? Hatred of present cars shouldn’t cloud our judgment of the future.

Homebound: Full Stack Homebuilding

TechCrunch reports that homebuilding startup Homebound has raised a $75 million Series C to expand beyond CA. Homebound seems to be a vertically-integrated homebuilder. They acquire land, build a home, and simplify the legal stuff. I honestly had a hard time grokking the essence of Homebound, which should not be interpreted as criticism of anything other than my grokking skills.

Any readers know the deets?

Charette in Porta Norte

Founder Henry Faarup shared a detailed look at his 8-day charrette to design Porta Norte, Panama (en Español).

In 2015, participants gathered in the beautiful Casco Viejo area of Panama City to strategize about parking, traffic flows, air and heat flow, walkable streets, and other elements of the master plan. The charrette counted several luminaries of the New Urbanism movement in their ranks.

The sketches and plans are gorgeous and very solarpunk:

Thanks for sharing, Henry!

Boy Scout Camp DAO Edition

Those who want to relive their Lord-Of-The-Flies days at Boy Scout camp now have a DAO to achieve their dream! $CAMP wants to buy up camps on offer from the Boy Scouts of America.

This is exactly the sort of project that DAOs could be great for — aggregating capital around a quirky, niche interest. Many Boy Scout camps are in beautiful spots. Some are surely lightly zoned or unzoned. The idea is also pure nostalgia marketing. Cashed up Millennials, now in their 30s and early 40s, can revisit the many, ahem, “formative experiences” they had at Scout Camp in the 90s.

Why not become a fractional owner of a pretty summer retreat? I’d be optimistic if $CAMP shares a reasonable business concept and organizes a management team that doesn’t believe in fancy token-voting stuff (NOT INVESTMENT ADVICE).

Construction Costs, A Deep Dive

Is there anyone writing about constructions costs better than Brian Potter? His latest analysis shows how construction costs drive the price of housing. The key finding:

50-80% of the cost of new housing is due to the costs of construction, depending on what you count as construction cost. Construction cost is thus the majority of cost for most new housing construction.

Coup in DAO-Land

In January’s roundup I wrote:

Many in the [DAO] space seem to think that the many problems with collective decision making are solved if they are made digital. On DAOs as a replacement for entrepreneurial leadership, I’m skeptical.

In February, the Build Finance DAO went all banana republic when a leader stole all the money and minted 1 billion tokens for themselves.

VICE reports that the coup stole nearly half a million dollars worth of tokens. It’s a sad outcome, though inevitable for a frontier like DAOs.

What’s most interesting is that the coup occurred via the DAO’s “democratic” machinery. Obviously CEOs, founders, and others have been known to defraud members. But I think there may be something especially brittle about technology that allows the resources and the control of those resources to be programmed by a single party.

In the “theory of the firm” literature, economists often talk about the separation of ownership and control — executives that control a firm often don’t have full ownership of the firm. DAOs are more like the fusion of ownership and control through code.

This may have benefits, such as the participatory elements of a DAO. But the sad fate of Build Finance shows it also has risks: one psycho can Web3 your DAO into oblivion.

Disney Wants to Build Towns and the Internet Reacted Exactly As You’d Expect

Disney announced their plans to build residential neighborhoods, called STORYLIVING. The neighborhoods, which look mostly like themed suburban housing developments, invite residents to enjoy Disney’s attention to customer experience in their everyday lives.

Despite the positive messaging by Disney, the internet exploded with cynicism at the announcement. The Verge described STORYLIVING as appealing to fans of Disney “who never want to leave its clutches” and added that residents can “Live, Breathe, (and Die)” Disney.

Brilliant Twitter analysts shared viral images of Mickey Mouse toting machine guns (since we know that happens all the time in Disney World, right?)

I’ve encountered this kind of weird, visceral hate for the idea that companies should build communities many times. It baffles me. Disney’s proposal is essentially a themed suburb in southern California. The landing page even focuses on retirees!

If people are afraid that machine-gun Mickey will patrol their streets, they can choose to live in the many, many thousands of other communities that have nothing to do with Disney. What’s the big deal?

This extreme closed-mindedness to anything new is especially confusing given the current state of many communities. We know that some existing cities struggle with serious problems, including violence, rising costs that hurt the poor, environmentally harmful policies, and infrastructure and services that barely work. Critics seem more fearful of an imaginary dystopia than they are of these problems which we know are real, right now.

STORYLIVING might be a good idea, or it might not. The market will decide. And, if it’s built, we’ll see just how relevant these criticisms prove to be.

I’ll close with this wisdom from Marc Andreessen, which made me laugh (and, honestly, made me imagine what Palo Alto would look like with enormous skyscrapers):

Startup Cities is growing quickly. I’ve met so many interesting people since my quiet little launch in January. The reader list now holds all sorts of cool people building the future of neighborhoods and cities.

❤️ I appreciate all of you who have shared the newsletter in these early days.

See you next week and don’t forget: Startups should build cities!

As always, great newsletter! I also was not surprised about the reaction to Disney's announcement but I personally love the idea. I actually thought about pitching CAA or one of the other big entertainment agencies on developing niche communities based on their stars (e.g. A Dollyland, Nick Jonasland, etc.) and potentially having clusters based on shared interests (e.g. if you like Miley Cyrus you would also like Mad Men so we'll have those communities intersect so you can hang with your fellow Hannah Montana/Mad Men fans).

As always, great newsletter! I also was not surprised about the reaction to Disney's announcement but I personally love the idea. I actually thought about pitching CAA or one of the other big entertainment agencies on developing niche communities based on their stars (e.g. A Dollyland, Nick Jonasland, etc.) and potentially having clusters based on shared interests (e.g. if you like Miley Cyrus you would also like Mad Men so we'll have those communities intersect so you can hang with your fellow Hannah Montana/Mad Men fans).